avtoelektrik-chrp.ru

Overview

Non Recourse Mortgage

Nonrecourse refers to a type of debt where the creditor may only look to the collateral to satisfy the unpaid loan, and not the debtor's personal assets. An example of a non recourse loan is a mortgage for a house that has been taken as collateral from the borrower. The lender can have no claim to any of the. A non-recourse loan is a loan secured by collateral, which is usually some form of property. If the borrower defaults, the issuer can seize the collateral but. Another advantage of a non-recourse loan is that it can enable an investor to borrow more. This is because the debt isn't tied to the borrower's income or total. Non-recourse loan is a loan that limits the lender's remedies to foreclosure of the mortgage and acquisition of the collateral in the event of financial. A non-recourse mortgage loan is a transaction where the Bank only has a security interest in the property being mortgaged not any other assets in the IRA or. A non-recourse loan is a type of debt that is secured only by the asset the loan finances. The lender has no other recourse, or ability to seize other assets if. A non-recourse loan is one in which the IRA account holder is not personally liable for repayment of the loan. The security instruments allow no recourse. A non-recourse debt is a type of loan that is secured by collateral, commonly property, and where the lender assumes a greater risk if the borrower defaults. Nonrecourse refers to a type of debt where the creditor may only look to the collateral to satisfy the unpaid loan, and not the debtor's personal assets. An example of a non recourse loan is a mortgage for a house that has been taken as collateral from the borrower. The lender can have no claim to any of the. A non-recourse loan is a loan secured by collateral, which is usually some form of property. If the borrower defaults, the issuer can seize the collateral but. Another advantage of a non-recourse loan is that it can enable an investor to borrow more. This is because the debt isn't tied to the borrower's income or total. Non-recourse loan is a loan that limits the lender's remedies to foreclosure of the mortgage and acquisition of the collateral in the event of financial. A non-recourse mortgage loan is a transaction where the Bank only has a security interest in the property being mortgaged not any other assets in the IRA or. A non-recourse loan is a type of debt that is secured only by the asset the loan finances. The lender has no other recourse, or ability to seize other assets if. A non-recourse loan is one in which the IRA account holder is not personally liable for repayment of the loan. The security instruments allow no recourse. A non-recourse debt is a type of loan that is secured by collateral, commonly property, and where the lender assumes a greater risk if the borrower defaults.

Non-Recourse Loan. NASB offers an IRA lending program to help individual investors with their financing needs with IRA and k accounts. NASB lends up to 70%. a non-recourse mortgage. compare recourse. Love words? Need even more definitions? Subscribe to America's largest dictionary and get thousands more. The meaning of NONRECOURSE LOAN is a loan by which a lender agrees to accept the collateral security in lieu of repayment from the borrower if he is unable. While recourse loans expose borrowers to greater personal liability, non-recourse loans offer a level of asset protection by limiting recourse to the collateral. Nonrecourse debt or a nonrecourse loan (sometimes hyphenated as non-recourse) is a secured loan (debt) that is secured by a pledge of collateral. "Nonrecourse loan" means a commercial loan secured by a mortgage on real property located in this state and evidenced by loan documents that meet any of the. A non-recourse loan is a loan where the borrower is not personally liable for repaying any outstanding balance on the loan, but the loan has to be secured by. If a borrower defaults on a non-recourse loan, the lender is only able to take the asset (property) used as loan collateral, nothing else. If the property. TowneBank Commercial Mortgage provides instant access to capital markets for commercial real estate. If a loan is non-recourse, a lender cannot go after a borrower's personal assets if they default on the loan. Instead, they can only attempt to repossess the. The following are the 12 non-recourse states where you can walk away from your mortgage and not have the lenders come after your other assets. The loan must be non-recourse, meaning the only collateral securing the loan is the property being purchased with the loan. Other assets held within the account. A non-recourse loan is a type of loan where the lender is only able to pursue the collateral of the loan in the event of a default. This means that the lender. When using leverage with retirement funds to make an investment, you must use a non-recourse loan. Understand the pros and cons of doing so. If you have a recourse loan, the bank can repossess your house if you don't are unable to pay your loan. Non-recourse loans do not work like that. Retirement accounts use a different type of mortgage financing called a non-recourse loan. Non-recourse loans collateralize the property, not you. Typically, a. A non-recourse loan (not in default) will be paid back solely through the property's rental income. This is a less consistent income stream than with a standard. A non-recourse loan limits the lender's recovery to the collateral, usually the property, without holding the borrower personally liable for any shortfall. TITAN LEASING How a Non-Recourse Loan can become a Recourse Loan Simply stated, a non-recourse loan is an arrangement where the borrower pledges collateral. With a non-recourse loan, the rental income from the property is deposited into your Self-Directed IRA, helping to repay the loan and build equity within your.

Where To Get The Lowest Auto Loan Rate

car UKFCU Auto Loans Once you've decided on the right car or truck, the next step is finding the right automobile loan. UKFCU makes the decision quick and. With lower interest rates than most dealer options, we can help you save money on your next new or pre-owned auto purchase. Loyalty Rate Discount Options – Get. Credit unions typically offer some of the lowest interest rates around and have long been considered the least expensive place to get a car loan. In fact, six. Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount; No application fees; Terms up to six years²; Onsite financing—tell the. Hello, as a car dealer, the lowest auto loan interest rate I've recently seen is around % for new cars and % for used cars. However. With Keesler Federal's special, limited-time auto loan rates starting as low as % APR* on new or used cars and easy, online application process. The lowest car loan rates you may see are 0%. These are usually offered by dealerships on new vehicles and can seem like a really great deal. However, there are. Vehicle loan rates with the avtoelektrik-chrp.ru discount currently as low as % APR, depending on credit history, loan term and vehicle model year. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. car UKFCU Auto Loans Once you've decided on the right car or truck, the next step is finding the right automobile loan. UKFCU makes the decision quick and. With lower interest rates than most dealer options, we can help you save money on your next new or pre-owned auto purchase. Loyalty Rate Discount Options – Get. Credit unions typically offer some of the lowest interest rates around and have long been considered the least expensive place to get a car loan. In fact, six. Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount; No application fees; Terms up to six years²; Onsite financing—tell the. Hello, as a car dealer, the lowest auto loan interest rate I've recently seen is around % for new cars and % for used cars. However. With Keesler Federal's special, limited-time auto loan rates starting as low as % APR* on new or used cars and easy, online application process. The lowest car loan rates you may see are 0%. These are usually offered by dealerships on new vehicles and can seem like a really great deal. However, there are. Vehicle loan rates with the avtoelektrik-chrp.ru discount currently as low as % APR, depending on credit history, loan term and vehicle model year. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision.

PenFed can be an excellent choice whether you're shopping for a new or used car or want to refinance your auto loan. The credit union offers affordable rates. New and Used Auto, Auto Lease Buy-outs, and Motorcycle Loans ; 48, %*, $ ; 60, %*, $ ; 72, %*, $ At Star One, you'll find very competitive low fixed rates for used cars under 10 years old. Get the same low auto loan rate, even on longer terms. Unlike. In fact, auto refinance loans are some of the cheapest loans that LightStream offers, with APRs as low as %. Borrowers take out the loan from LightStream. Auto loan rates as low as % APR for used vehicles with a maximum age of 10 years with less than , miles. Income subject to verification. Must use auto. Compare auto loan rates in September ; Upstart, %%, months ; PenFed Credit Union, Starting at %, months ; Carputty, Starting at Loan must be secured by a or newer Auto and under 50, miles ; Months, As low as %* ; Months, As low as %* ; Months, As low as. UFirst Credit Union makes it easy for you to get the best auto loan rates in Utah. Whether you're looking for a new car loan or to refinance your current. A credit union car loan that puts you in the driver's seat ; New Vehicle Rate, % APR ; Used Vehicle Rate, % APR ; Vehicle Refinance, % APR ; Used. loan amount, current mileage, term of the loan and loan to value. A lower credit score may cause a higher loan rate. Used Car Loans. Term*. Rate**. 48 Months. Navy Federal offers competitive auto loan rates for new and used vehicles. See how much money you could save on new or used car financing today. PenFed can be an excellent choice whether you're shopping for a new or used car or want to refinance your auto loan. The credit union offers affordable rates. Auto Loan Rates ; APR1 As Low As ; New or Used Auto Loan (Less Than 2 Years Old). APR1 As Low As. % ; Used Auto Loan (2 – 6 Years Old). APR1 As Low As. %. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. Vehicle loan rates with the avtoelektrik-chrp.ru discount currently as low as % APR, depending on credit history, loan term and vehicle model year. Or take advantage of our low rates to refinance1 a higher-interest auto loan, lower your payments and save a bundle. Pick the option that's right for you. Get an immediate auto loan decision with our fast, free online application. Our personalized, low rate loans are easily managed online or with our app. Auto Loan Rates as low as % APR* · Save up to $1, with CA Community CU auto loans. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts car, and it can lower your. Auto Loans ; Cars, trucks, vans - new ( and newer) · months · % - % · $ based on a 60 month, $15, loan at % APR* ; Cars, trucks, vans.

Roof Maintenance Cost

New roof costs typically range from $15, to $27,, but many homeowners will pay around $21, on average. Pricing varies greatly depending on several. 4 Roof Repair Cost Factors · Size of Repair: Roof repair costs will be higher the larger the damaged area is. · Type of Repair: Repairs that are more common, like. Small repairs tend to cost just a couple hundred dollars. Moderate repairs will cost up to about $1, And the cost for large repairs is subject to inspection. Replace & Match Missing Shingles: $, Satellite Dish Removal w/ Shingle Replacement: $, Install Solar Attic Fan: $, Roof Tune-Up: $ How Much Does It Typically Cost to Repair a Leaky Roof? As stated above, minor asphalt shingle roof leaks cost $ to repair. Moderate leak repairs on. 15, sq ft roof depending on variables running about 8 bucks a foot but can go to 12 for a flat roof just varies on time of the year, amount of labor hours to. The national average roof repair cost is around $, but a minor repair costs only $ to $* Some examples of less intensive roof repairs include patching. How much does flat roof repair and replacement cost in ? And what roof conditions and labor factors will impact this cost? Learn more here. Assuming your roof is $15, square feet in area, you can expect to spend around $ for an annual roof maintenance visit. Keep in mind this isn't a concrete. New roof costs typically range from $15, to $27,, but many homeowners will pay around $21, on average. Pricing varies greatly depending on several. 4 Roof Repair Cost Factors · Size of Repair: Roof repair costs will be higher the larger the damaged area is. · Type of Repair: Repairs that are more common, like. Small repairs tend to cost just a couple hundred dollars. Moderate repairs will cost up to about $1, And the cost for large repairs is subject to inspection. Replace & Match Missing Shingles: $, Satellite Dish Removal w/ Shingle Replacement: $, Install Solar Attic Fan: $, Roof Tune-Up: $ How Much Does It Typically Cost to Repair a Leaky Roof? As stated above, minor asphalt shingle roof leaks cost $ to repair. Moderate leak repairs on. 15, sq ft roof depending on variables running about 8 bucks a foot but can go to 12 for a flat roof just varies on time of the year, amount of labor hours to. The national average roof repair cost is around $, but a minor repair costs only $ to $* Some examples of less intensive roof repairs include patching. How much does flat roof repair and replacement cost in ? And what roof conditions and labor factors will impact this cost? Learn more here. Assuming your roof is $15, square feet in area, you can expect to spend around $ for an annual roof maintenance visit. Keep in mind this isn't a concrete.

Replace any missing or damaged shingles. Cost is between $ depending size and steepness.

However, to give you a starting point, expect to pay anywhere from $5, to $15, for a standard roof replacement in Florida. This range considers factors. Although close to $ may seem like a lot to spend on total roof cleaning, it could be worth your while if you don't have the necessary supplies, skills, or. The average cost of replacing a clay tile roof is between $25, and $55, This price range includes the cost of materials and labor. The cost of materials. The average cost to replace a roof can vary significantly. According to HomeAdvisor, the typical range for roof replacement costs is between $5, and $11, The average middle-ground cost of roof repairs is $ to $ However, some repairs cost much less while others cost much more. It depends on your roofing material and design complexity. Asphalt shingles might be cheaper to fix, but slate or tile could cost more due to their durability. The average roof replacement cost, by the numbers · Overlays range from $6, to $8, · A new roof (via a tear-off) will typically range from $13, to. Most minor roof repairs come in under $, some being as low as $ For more severe roof repairs, you can expect to pay up to $15, (In this case, you're. The average roof replacement cost is about $, according to data collected by avtoelektrik-chrp.ru and updated in September In this article, we aim to demystify the costs associated with roof leak repairs. We'll discuss the urgency of addressing these issues, and offer insights into. The cost of cleaning and maintaining natural cedar roofing material can range from $ to $ per square foot, depending on the size and complexity of your. It generally costs three times the amount of money to dispatch a repair crew for an emergency repair than to handle it during a routine maintenance visit. The average cost to repair a roof is about $ (Repairing and replacing dislodged shingles after a severe weather event on a gently sloped roof). The cost of your roof repair will greatly depend on the material needed and the time required to fix it. The expert in the field of construction and repair always advised that it is never too late to do repairs otherwise you will have to pay more than before. “I'm not sure whether to go ahead with roof repairs or simply to replace my old roof. What should I do?” For starters, The average new roof cost for a 1, The cost of a roof replacement can vary depending on the size of the roof and the type of roofing material used. The average roof replacement cost ranges. On a national level, the average cost to replace a roof is $7, As noted above, there are many factors influencing the cost. The cost of your roof could be. According to HomeAdvisor, the average cost of repairing a roof in Pennsylvania is $, with a typical range of $ to $1, However, it's important to note.

In Which Crypto Currency To Invest

Crypto is a new, highly volatile asset class, and you need to be comfortable with the risks before taking action. I've handpicked a list of the most promising crypto assets that are often considered by many traders to be the best cryptos for short-term gains. Bitcoin (BTC) Bitcoin, the most well-known cryptocurrency, allows for direct peer-to-peer exchange of value on a decentralized payment network. 09 Other ways to invest in crypto assets. 10 Crypto-related investment scams and fraud. 12 Considerations before investing in crypto assets. 14 The bottom line. Bitcoin (BTC) Bitcoin, the most well-known cryptocurrency, allows for direct peer-to-peer exchange of value on a decentralized payment network. Crypto is a new, highly volatile asset class, and you need to be comfortable with the risks before taking action. The best project to invest in is BTC and ETH. They are the safest and most reliable crypto assets. Solana is pretty awesome just like you. We won't recommend any particular coin or token as the best crypto to invest in, but we can share some general principles for building a portfolio for long-. Facts About Investing with Cryptocurrency · Cryptocurrencies aren't backed by a government or central bank. · If you store your cryptocurrency online, you don't. Crypto is a new, highly volatile asset class, and you need to be comfortable with the risks before taking action. I've handpicked a list of the most promising crypto assets that are often considered by many traders to be the best cryptos for short-term gains. Bitcoin (BTC) Bitcoin, the most well-known cryptocurrency, allows for direct peer-to-peer exchange of value on a decentralized payment network. 09 Other ways to invest in crypto assets. 10 Crypto-related investment scams and fraud. 12 Considerations before investing in crypto assets. 14 The bottom line. Bitcoin (BTC) Bitcoin, the most well-known cryptocurrency, allows for direct peer-to-peer exchange of value on a decentralized payment network. Crypto is a new, highly volatile asset class, and you need to be comfortable with the risks before taking action. The best project to invest in is BTC and ETH. They are the safest and most reliable crypto assets. Solana is pretty awesome just like you. We won't recommend any particular coin or token as the best crypto to invest in, but we can share some general principles for building a portfolio for long-. Facts About Investing with Cryptocurrency · Cryptocurrencies aren't backed by a government or central bank. · If you store your cryptocurrency online, you don't.

avtoelektrik-chrp.ru offers an overview of cryptocurrency markets, ideal for tracking prices and exchange rates. * Real-Time and historical price data tracking for. The best project to invest in is BTC and ETH. They are the safest and most reliable crypto assets. Solana is pretty awesome just like you. As cryptocurrencies experience volatility, whether cryptos is a good investment depends on how much risk you can bear. Top 10 Cryptos to Invest In August · Bitcoin (BTC) · Ethereum (ETH) · Binance Coin (BNB) · Solana (SOL) · Ripple (XRP) · Dogecoin (DOGE) · Polkadot (DOT). 1. Ethereum (ETH) · 2. Tether (USDT) · 3. XRP · 4. Binance Coin (BNB) · 5. USD Coin (USDC) · 6. Cardano (ADA) · 7. Solana (SOL) · 8. Dogecoin (DOGE). 1. Ethereum (ETH) · 2. Tether (USDT) · 3. XRP · 4. Binance Coin (BNB) · 5. USD Coin (USDC) · 6. Cardano (ADA) · 7. Solana (SOL) · 8. Dogecoin (DOGE). Cryptocurrencies – in particular, Bitcoin – continue to capture the attention of investors. At the beginning of Bitcoin was at multi-year lows. Cryptocurrency is a digital payment system that doesn't rely on banks to verify transactions. It's a peer-to-peer system that can enable anyone anywhere to. We are here to help by providing insights into the best crypto choices for current market conditions. Read on for our top picks of the best crypto to buy now! Powerful Diversifier or Portfolio Kryptonite? Download UNDERSTANDING THE CRYPTOCURRENCY ECOSYSTEM Explore BITCOIN: NOT QUITE A CURRENCY Explore. Cryptocurrency comes under many names. You have probably read about some of the most popular types of cryptocurrencies such as Bitcoin, Litecoin. Powerful Diversifier or Portfolio Kryptonite? Download UNDERSTANDING THE CRYPTOCURRENCY ECOSYSTEM Explore BITCOIN: NOT QUITE A CURRENCY Explore. Latest news on Cryptocurrency today, top cryptocurrency prices bitcoin, dogecoin, ethreum Invest in top cryptocurrencies all over the world. See the top. Some crypto ETNs track a basket of different currencies and thus offer the possibility to invest in several cryptocurrencies with one single product. Another. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC). When a cryptocurrency is minted, created prior to. This list tracks public non-cryptocurrency companies that have exposure to crypto, either through investments, partnerships, or side ventures. Cryptocurrencies tend to be more volatile than more traditional investments, such as stocks and bonds. An investment that's worth thousands of dollars today. Trade in minutes from only €1. Your No.1 European broker for stocks, crypto, indices, ETFs and precious metals. Trade 24/7. Fee-free on all deposits. This article provides practical information and resources around passive vs. active cryptocurrency investing, how to buy, sell, store, and monitor. Your cryptocurrency investments are held in your Bakkt Crypto account, which is separate from your brokerage account with Public Investing. Public Investing is.

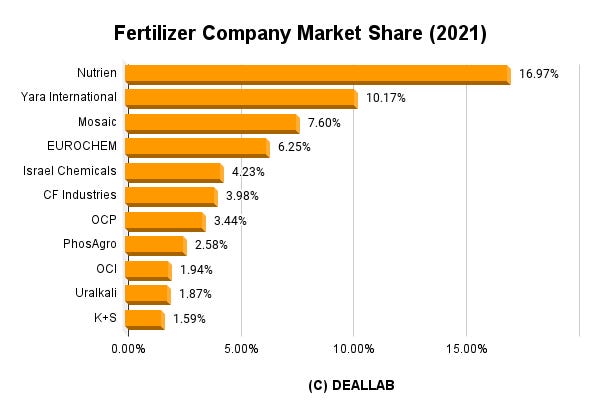

Canadian Fertilizer Company Stocks

Potash Corp. of Saskatchewan Inc., the world's largest fertilizer producer, declined percent as wheat fell after Statistics Canada forecast more planting. Financial data provided by Quote Media captures transactions reported on SEDI. Have an issue with this listing or want to update your company's description? NTR | Complete Nutrien Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Stock and Credit Information · Stock Quote & Chart · Analyst Coverage · Analyst We bring together our industry know-how and advanced fertilizer solutions. Which is better to invest in, the US or the Canadian stock market? This one is easy, the US stock markets by a mile. Canadian companies don. ” Earlier this week industry group Fertilizer Canada said disruptions to Municipalities do not have weeks of chlorine stocks, meaning that a supply. Nutrien retreats in Brazil after mishaps, executive departures. Canada's largest fertilizer company Nutrien: Top 25 Undervalued Toronto Stock Exchange Stocks. Fertilizer Industry Ambitions · Fertilizer Industry by Numbers · Our Members fertilizer distribution caused by the upcoming rail strikes in Canada. Canadian stocks fall on foreign data, Mali coup. Mar. 22, at Great Quest Fertilizer Ltd. is an exploration company. The firm engages in. Potash Corp. of Saskatchewan Inc., the world's largest fertilizer producer, declined percent as wheat fell after Statistics Canada forecast more planting. Financial data provided by Quote Media captures transactions reported on SEDI. Have an issue with this listing or want to update your company's description? NTR | Complete Nutrien Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Stock and Credit Information · Stock Quote & Chart · Analyst Coverage · Analyst We bring together our industry know-how and advanced fertilizer solutions. Which is better to invest in, the US or the Canadian stock market? This one is easy, the US stock markets by a mile. Canadian companies don. ” Earlier this week industry group Fertilizer Canada said disruptions to Municipalities do not have weeks of chlorine stocks, meaning that a supply. Nutrien retreats in Brazil after mishaps, executive departures. Canada's largest fertilizer company Nutrien: Top 25 Undervalued Toronto Stock Exchange Stocks. Fertilizer Industry Ambitions · Fertilizer Industry by Numbers · Our Members fertilizer distribution caused by the upcoming rail strikes in Canada. Canadian stocks fall on foreign data, Mali coup. Mar. 22, at Great Quest Fertilizer Ltd. is an exploration company. The firm engages in.

The materials sector, which includes precious and base metals miners and fertilizer companies, rose percent, with First Quantum Minerals Ltd jumping Nutrien's common shares are listed on the Toronto and New York Stock Exchanges under the trading symbol NTR. or its nominee, CDS & Co., will receive their. The Potash Corporation of Saskatchewan, also known as PotashCorp, was a company based in Saskatoon, Saskatchewan. The company merged with Calgary-based. its shares (versus the $2, average on the Street). Returning Canadian companies are: Page 2. * Alimentation Couche-Tard Inc. (ATD-T +%increase). Take a deeper dive into fertilizer stocks · 1. Scotts Miracle-Gro Company (SMG) · 2. CF Industries (CF) · 3. Bunge (BG) · 4. Intrepid Potash (IPI) · 5. Nutrien (NTR). Organic fertilizer companies such as EarthRenew (CSE:ERTH) and MustGrow Biologics (CSE:MGRO,OTCQB:MGROF) are developing product formulations that help build the. China Green Agriculture, Inc., through its subsidiaries, engages in the research, development, production, and sale of various fertilizers, agricultural. Canadian Companies Reporting Earnings this Week (Aug ). (NTR-T) Frequently Asked Questions. What is Nutrien Ltd. stock symbol? Nutrien Ltd. is a Canadian. Fertilizer Industry Gaining Stability: 3 Stocks To Buy Now. The fertilizer industry The company is headquartered in Saskatoon, Canada. Read More. Top fertilizer companies by dividend yield ; favorite icon, 8. CF Industries logo. CF Industries. 8CF ; favorite icon, 9. Rashtriya Chemicals and Fertilizers logo. ranked list of publicly traded Fertilizer companies. Find the best Fertilizer Stocks to buy. A fertilizer (American English) or fertiliser (British English;. Nutrien's common shares are listed on the Toronto and New York Stock Exchanges under the trading symbol NTR. or its nominee, CDS & Co., will receive their. Also check out Equitymaster's powerful stock screener to find the top fertilizer companies in India. Canada or the European Union countries, where such. I bought a few stocks in my TFSA during covid unfortunately when a few stocks were over valued. Canadian sub but recently trying to get more exposure outside. fertilizer industry and a good option for investors looking to invest in fertilizer stocks. Nutrien is a Canadian-based fertilizer company. Information about which ETFs are holding the stock POT, Potash Corp of Saskatchewan Inc, from ETF Channel 10 Canadian Stocks Crossing Below Their Day. Complete SOPerior Fertilizer Corp. stock information by Barron's. View real-time SOP.H stock price and news, along with industry-best analysis. Richardson International is Canada's largest agribusiness and is recognized as a global leader in agriculture and food processing. View Profile. Members. Fertilizer · Temperature Controlled Cargo · Forest Products · Dimensional Loads Canadian National Railway Company. Terms Conditions Privacy · Like us on.

Us Real Estate Mutual Funds

Top REIT Mutual Funds · 1. Baron Real Estate Fund · 2. Cohen & Steers Real Estate Securities Fund · 3. PIMCO Real Estate Real Return Strategy Fund · 4. TIAA-CREF. The Vanguard REIT Index Fund follows the MSCI US REIT Index, an index that tracks domestic equity real estate investment trusts (REITs and firms that manage. Real Estate Funds. ETFs and mutual funds in this sector focus on mortgage companies, property management companies, REITs (Real Estate Investment Trusts). Real estate investments, including real estate investment trusts, are subject to risks similar to those associated with the direct ownership of real estate and. The Short Real Estate ProFund seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P. The Real Estate Securities Fund is a portfolio of primarily U.S. equity real estate investment trusts. avtoelektrik-chrp.ru provides a list of real estate funds that can be sorted by Morningstar rating, performance, and net assets. Definition: Real Estate ETFs invest in the U.S. real estate market. Note that there are various structures and focuses in these ETFs, but the majority. Real estate mutual funds and ETFs invest primarily in securities offered by public real estate companies, including commercial and corporate properties. Top REIT Mutual Funds · 1. Baron Real Estate Fund · 2. Cohen & Steers Real Estate Securities Fund · 3. PIMCO Real Estate Real Return Strategy Fund · 4. TIAA-CREF. The Vanguard REIT Index Fund follows the MSCI US REIT Index, an index that tracks domestic equity real estate investment trusts (REITs and firms that manage. Real Estate Funds. ETFs and mutual funds in this sector focus on mortgage companies, property management companies, REITs (Real Estate Investment Trusts). Real estate investments, including real estate investment trusts, are subject to risks similar to those associated with the direct ownership of real estate and. The Short Real Estate ProFund seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P. The Real Estate Securities Fund is a portfolio of primarily U.S. equity real estate investment trusts. avtoelektrik-chrp.ru provides a list of real estate funds that can be sorted by Morningstar rating, performance, and net assets. Definition: Real Estate ETFs invest in the U.S. real estate market. Note that there are various structures and focuses in these ETFs, but the majority. Real estate mutual funds and ETFs invest primarily in securities offered by public real estate companies, including commercial and corporate properties.

Cohen & Steers Real Estate Securities Fund seeks total return through investment in real estate securities. See U.S. Real Estate. 23 years of experience. Real estate securities and REITs offer potential for diversification and attractive yield. Proven investment process, market experts. CBRE Investment Management. The fund's goal is to track as closely as possible, before fees and expenses, the total return of an index composed of US real estate investment trusts. The investment seeks capital growth and income consistent with prudent investment management. The fund invests at least 80% of its net assets in securities of. This fund invests in real estate investment trusts—companies that purchase office buildings, hotels, and other real estate property. What are the best real estate investment funds? · The Vanguard Real Estate Index Fund (VGSLX %). · Vanguard also offers an ETF version, Vanguard Real Estate. Fidelity® Real Estate Index Fund FSRNX · Fidelity® Real Estate Investment Portfolio FRESX · Cohen & Steers Realty Shares Fund Class A CSJAX · American Century. The fund's goal is to track as closely as possible, before fees and expenses, the total return of an index composed of US real estate investment trusts. Open-end mutual fund which seeks to achieve long-term capital appreciation. Specific ESG Focus: Sustainability as a business driver in public real estate. Investing in a real estate mutual fund is a smart way for investors unable to or uninterested in buying property to acquire shares in real estate at a low price. The Fund seeks to achieve its investment objective by investing in the equity securities of Real Estate Investment Trusts (REITs) and real estate-related. A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns—and in most cases operates—income-producing real. REITs offer a way to include real estate in one's investment portfolio. Additionally, some REITs may offer higher dividend yields than some other investments. The mutual funds referred to in this website are offered and sold only to persons residing in the United States and are offered by prospectus only. The. Real estate companies and Real estate investment trusts (REITS) may be leveraged, which increases risk. REIT performance depends on the strength of the real. Portfolio management. Principal Real Estate. Our experienced investment teams provide comprehensive, specialized, and sustainable capabilities across all four. Invest in world-class private market investments like real estate, venture capital, and private credit. Fundrise is America's largest direct-access. The Fund invests primarily in equity securities of companies in the U.S. real estate industry. The Fund emphasizes bottom-up stock selection with a top-down. The iShares Residential and Multisector Real Estate ETF seeks to track the investment results of an index composed of US residential, healthcare and self-.

Penny Stock Trading Simulator

Main Features of App Stock Market Simulator for Your Paper - Virtual Trading: +) LIVE MARKET: live stock quotes for stocks on Nasdaq, NYSE. Start investing with Webull's intuitive platform for stocks, options, and ETFs. Join now for free trading tools and community insights. Any standard stock trading simulator will allow you to punch in the symbols for penny stocks just the same as you would punch in the symbols. The four top penny stock chart patterns to trade. How to find the best trading simulator and begin practicing day trading penny stocks. Requirements. By default the volume in the real markets must be double the amount you are attempting to trade. 5. No Shorting Penny Stocks: You may not short sell any stock. Rules: $5 minimum stock price (was sad about this rule because I wanted to gamble on penny stocks lol), no short selling, each position can. StockMarketSim is a simple, easy, and fun virtual stock market game. You start off with $10, and can place unlimited trades, any time of the day. The. Each team begins the simulation with $, in cash and may borrow additional funds. How much you may borrow is dependent on the equity in your account. Our Paper Trading Simulator allows you to practice trading using virtual currency. You'll have the ability to trade USA Equities Markets & US Options. Main Features of App Stock Market Simulator for Your Paper - Virtual Trading: +) LIVE MARKET: live stock quotes for stocks on Nasdaq, NYSE. Start investing with Webull's intuitive platform for stocks, options, and ETFs. Join now for free trading tools and community insights. Any standard stock trading simulator will allow you to punch in the symbols for penny stocks just the same as you would punch in the symbols. The four top penny stock chart patterns to trade. How to find the best trading simulator and begin practicing day trading penny stocks. Requirements. By default the volume in the real markets must be double the amount you are attempting to trade. 5. No Shorting Penny Stocks: You may not short sell any stock. Rules: $5 minimum stock price (was sad about this rule because I wanted to gamble on penny stocks lol), no short selling, each position can. StockMarketSim is a simple, easy, and fun virtual stock market game. You start off with $10, and can place unlimited trades, any time of the day. The. Each team begins the simulation with $, in cash and may borrow additional funds. How much you may borrow is dependent on the equity in your account. Our Paper Trading Simulator allows you to practice trading using virtual currency. You'll have the ability to trade USA Equities Markets & US Options.

Winning virtual trading games, like avtoelektrik-chrp.ru, where the stock market game Penny Stock trading. Yes, a student can achieve far greater returns in. Teams may not buy or short sell stocks trading for under $ per share (no penny stocks). The maximum number of shares a team may trade is limited to half the. Stock market simulator - Play an exciting virtual stock market game by DSIJ with virtual cash of Rs & learn about the working process of the stock. Stock Trading Prop Firm - Trade More Than Stocks and ETFs - Even Penny Stocks. TTP stocks prop firm is where you ought to be! Penny Stock alert: day trading app lets you pick the ideal stocks that will bring you the best possible returns in the short and long term. Get hands-on experience trading stocks without risking real money. Learn how to trade and invest in the stock market with a stock market simulator and. penny on an actual stock exchange. Zero Risk. Use our free trading simulator to practise trading risk-free. Unlimited Virtual Cash. Trade as many paper trading. Penny Stock Simulation; Finance News & Many More Features; No 1 Stock Simulator for Trading Practise. stock market game. Stock Simulator Frequently Asked. Stock market simulators are software programs that generate simulated stock market environments to help beginners learn trading while practising. These costs which are monthly, add up to a pretty penny by the end of the year. stock market simulator: Indices. SPDR Trust Series I (SPY); iShares Russell. Rules: $5 minimum stock price (was sad about this rule because I wanted to gamble on penny stocks lol), no short selling, each position can. Best Overall: Fidelity Investments · Best for Low Costs: Fidelity Investments · Best for Risk Management: Interactive Brokers · Best for Advanced Traders. Experience live stock trading on India's first % real-time platform using virtual money. Test strategies, trade equities, options, and futures. These costs which are monthly, add up to a pretty penny by the end of the year. stock market simulator: Indices. SPDR Trust Series I (SPY); iShares Russell. Stock Market Investing Level 3: Trade penny stocks & invest in new companies. $25 per class. Lisa Kornberg. (1,). Group Class. 4 wks, 1/wk, 1 hr. Small CapPenny Stock TradingDay Trading Stocks. How To's. How to Day Trade trading simulator platform to provide our students with the most realistic Trading. Results · PennyGems: Penny Stock Trading · Stock Market Map · Online SIP calculator with inflation · ETFon: ETF Scanner & Analyzer · Crypto Currency Heat Map · Forex. Description. USA stock market trade simulator game! (previously known as – Penny stocks supported – Tablet mode supported. *** Needs a good Internet. Stock Trading Simulators Introduction. Practicing trading in a stock simulator is essential to becoming a good trader. You don't want to get burned out. Learn how to trade in the penny stock market and arm yourself with these essential tips to increase your chances of success.

In House Loan Meaning

Let's start with the definition that explains what a mortgage is. A mortgage is a loan from a lender that gives borrowers the money they need to buy or. Your signature as a co-signer on a mortgage note means you agree to pay off the loan or take over the payments if the borrower stops paying. This can be a. In house lending is a type of seller financing in which a company or broker will help a customer obtain a loan at their place of business to purchase any. Not only will it affect how much you'll need to borrow, it can also influence: Whether your lender will require you to pay for private mortgage insurance (PMI). The CalHFA Conventional program is a first mortgage loan insured through private mortgage CalHFA's subordinate loans are "silent seconds", meaning payments on. This may mean paying down credit card debt and other installment loans. If you have a loan on a depreciating asset like a recreational vehicle, you may want. A home mortgage is a loan given by a bank, mortgage company, or other financial institution for the purchase of a primary or investment residence. A mortgage is a type of loan consumers use to purchase a house and agree to repay in equal, fixed monthly amounts over a certain time span, or term. The meaning of HOME LOAN is a legal agreement in which a person borrows money to buy property (such as a house) and pays back the money over a period of. Let's start with the definition that explains what a mortgage is. A mortgage is a loan from a lender that gives borrowers the money they need to buy or. Your signature as a co-signer on a mortgage note means you agree to pay off the loan or take over the payments if the borrower stops paying. This can be a. In house lending is a type of seller financing in which a company or broker will help a customer obtain a loan at their place of business to purchase any. Not only will it affect how much you'll need to borrow, it can also influence: Whether your lender will require you to pay for private mortgage insurance (PMI). The CalHFA Conventional program is a first mortgage loan insured through private mortgage CalHFA's subordinate loans are "silent seconds", meaning payments on. This may mean paying down credit card debt and other installment loans. If you have a loan on a depreciating asset like a recreational vehicle, you may want. A home mortgage is a loan given by a bank, mortgage company, or other financial institution for the purchase of a primary or investment residence. A mortgage is a type of loan consumers use to purchase a house and agree to repay in equal, fixed monthly amounts over a certain time span, or term. The meaning of HOME LOAN is a legal agreement in which a person borrows money to buy property (such as a house) and pays back the money over a period of.

When you take out a mortgage, you promise to repay the money you've borrowed at an agreed-upon interest rate. The home is used as collateral. That means if you. Down Payment Definition A down payment on a house is the money a buyer pays upfront to complete the real estate transaction. Down payments are typically a. If the title comes up clean, it's time to close on your mortgage loan, which means putting down the largest sum of money: The down payment and closing costs. Manage your health Learn what this law means for Veterans and their survivors. Manage your benefits Use this program to get a faster decision by. An in-house loan is a loan that is issued directly from a business to its clients via in-house financing. This means that the customer deals exclusively with. What Is Mortgage? A mortgage is a loan financing the purchase or maintenance of a property, land, or other types of rental properties. The lender agrees to pay. For example, if you are buying a home for $, the lender may ask you for a down payment of 5%, which means you would be required to have $5, in cash as. Great investment potential: Cash-only homes tend to cost less upfront because of their distressed condition. Skipping a mortgage also means no fees or interest. What is an Assumable mortgage Assumable mortgages are mortgages that can be assumed by the buyer when you sell your home. This is a great feature that is well. A home loan is an amount an individual borrows from a financial institution such as a housing finance company to buy a new or a resale home. A mortgage loan that has the standard features as defined by (and is eligible for sale to) Fannie Mae and Freddie Mac. Construction loan. A short-term interim. A mortgage loan or simply mortgage in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise. Processing: The preparation of a mortgage loan application and supporting documents for consideration by a lender. Program: The term "Program" refers to any. Generally, a down payment is a percentage of the total cost being borrowed. It's important to note that any down payment under 20% normally requires mortgage. In-house financing occurs when the seller assumes all risk associated with the loan and chooses who is authorized and what terms to offer. This contrasts with. Federal Housing Administration (FHA) insures mortgage loans made by private lending institutions to finance the purchase of a new or used manufactured home. Also known as a “conforming” loan, a conventional mortgage loan is any type of home loan that is guaranteed by a private lender or a government-sponsored. Basically, it means that you take on a loan (i.e. you get cash but have to pay it back with interest, usually in fixed rates) which is. A mortgage with an interest rate that can change according to a schedule outlined in the Note (Note Rate). The interest rate is based upon an index that changes.

What Is Positioning Strategy

Communicating your positioning strategy begins with creating a positioning statement and sharing it internally across the organization to make sure that. Strategic positioning is an essential part of the planning that goes into digitally marketing a brand or product. The process of plotting your strategic. Strategic positioning reflects choices a company makes about the kind of value it will create and how that value will be created differently than rivals. There are basically five positioning strategies, which include positioning based on product characteristics, positioning based on price. Brand positioning is a business strategy that communicates your unique value proposition and what distinguishes your brand. It tells customers why they should. “A marketing strategy that aims to make a brand occupy a distinct position, relative to competing brands, in the mind of the customer. Companies. A brand positioning strategy helps you to manage how you're perceived in the market, and sets you apart from the competition. Build your winning strategy with. The goal of a positioning strategy is to carve out a market position where your business can achieve good margins and maintain a competitive. Positioning strategies involve the combination of seven components: customer, competition, company, collaborators, context channel and content. This strategy. Communicating your positioning strategy begins with creating a positioning statement and sharing it internally across the organization to make sure that. Strategic positioning is an essential part of the planning that goes into digitally marketing a brand or product. The process of plotting your strategic. Strategic positioning reflects choices a company makes about the kind of value it will create and how that value will be created differently than rivals. There are basically five positioning strategies, which include positioning based on product characteristics, positioning based on price. Brand positioning is a business strategy that communicates your unique value proposition and what distinguishes your brand. It tells customers why they should. “A marketing strategy that aims to make a brand occupy a distinct position, relative to competing brands, in the mind of the customer. Companies. A brand positioning strategy helps you to manage how you're perceived in the market, and sets you apart from the competition. Build your winning strategy with. The goal of a positioning strategy is to carve out a market position where your business can achieve good margins and maintain a competitive. Positioning strategies involve the combination of seven components: customer, competition, company, collaborators, context channel and content. This strategy.

An effective positioning strategy considers the strengths and weaknesses of the organization, the needs of the customers and market and the. Product positioning is planning for how people in the market will think about your product. And, remember that your product has a life of its own. Positioning strategies refer to the various methods a company can use to communicate product features and benefits in order to make a lasting impression on the. Positioning is a strategic process that marketers use to determine the place or “niche” an offering should occupy in a given market, relative to other customer. Positioning strategy is the deliberate process by which your organization identifies its strengths, assesses gaps in the competitive landscape, and chooses how. By shaping consumer preferences, brand positioning strategies are directly linked to consumer loyalty, consumer-based brand equity, and the willingness to. Communicating your positioning strategy begins with creating a positioning statement and sharing it internally across the organization to make sure that. Product positioning is the exercise of determining how the market should feel and think about your product. ✓ Learn key positioning strategies in our guide. Competitive positioning is about differentiating to win mindshare of the market. Follow this step-by-step process for your competitive positioning strategy. The price-based positioning strategy is a marketing approach where a company positions its product or service as the most affordable option available in the. A positioning strategy is like the way a brand wants to be known and remembered by its customers. It's about telling people why a product or company is better. Brand positioning refers to the unique value that a brand presents to its customer. It is a marketing strategy brands create to establish their brand identity. Planning Your Brand Differentiation Strategy · Positioning is the place you hold in the mind's eye of your target audience. · Differentiation is how your firm. There are many ways to craft your plan, from product positioning to competitive positioning. The most effective positioning strategy will depend on your target. A marketing positioning strategy is designed to carve out and amplify an identity different from your competitors. Positioning refers to the development of strategy that helps to influence how a particular market segment perceives a brand, good, or service in comparison to. Product positioning is the strategic process of creating a distinct perception and identity for a product in the minds of target customers. Strategic positioning is all about where a company stands in the market. It's how a business distinguishes itself from its competitors and how it is perceived. Strategic positioning is a business strategy where an organization differentiates itself from competitors by creating better value for its customers. Positioning Strategies in Marketing a) This is a commonly used strategy and consists of associating an object with a product characteristic or customer.

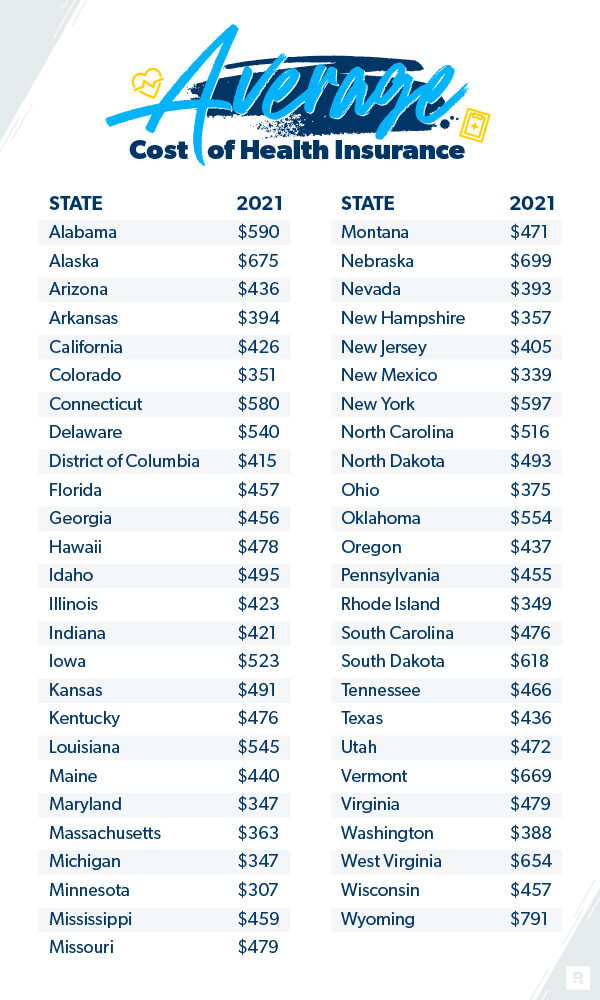

Average Insurance Cost A Month

Average Single Coverage Premium/Month. Employer plan, $ ACA plan, $ ; Member Age, Monthly Cost. Age 18, $ Age 21, $ ; Company, Monthly Cost. General liability insurance cost · While Insureon's small business customers pay an average of $42 monthly for general liability coverage, 29% pay less than $ The national average cost of home insurance is $2, per year for a policy with a $, dwelling limit. This evens out to about $ per month. But these. If you are a low- or moderate-income Californian, you may get help buying insurance from Covered California through monthly subsidies that lower your. In , the national median monthly cost of a general liability policy for new Progressive customers was $ The average rate was $80 per month. So what can. Premiums are the payments you make each month to your insurance company for your health insurance coverage. You'll need to you pay this bill every month, to. Total yearly costs include: Monthly premium x 12 months: The amount you pay to your plan each month to have health insurance. Deductibles: How much you'. How much is the average cost of car insurance each year? Generally speaking, the average cost is about $1, However, this number can only tell drivers so. In , the average premium for non-subsidized health insurance for a family of four was $1, per month.* Family insurance plan costs can vary based on the. Average Single Coverage Premium/Month. Employer plan, $ ACA plan, $ ; Member Age, Monthly Cost. Age 18, $ Age 21, $ ; Company, Monthly Cost. General liability insurance cost · While Insureon's small business customers pay an average of $42 monthly for general liability coverage, 29% pay less than $ The national average cost of home insurance is $2, per year for a policy with a $, dwelling limit. This evens out to about $ per month. But these. If you are a low- or moderate-income Californian, you may get help buying insurance from Covered California through monthly subsidies that lower your. In , the national median monthly cost of a general liability policy for new Progressive customers was $ The average rate was $80 per month. So what can. Premiums are the payments you make each month to your insurance company for your health insurance coverage. You'll need to you pay this bill every month, to. Total yearly costs include: Monthly premium x 12 months: The amount you pay to your plan each month to have health insurance. Deductibles: How much you'. How much is the average cost of car insurance each year? Generally speaking, the average cost is about $1, However, this number can only tell drivers so. In , the average premium for non-subsidized health insurance for a family of four was $1, per month.* Family insurance plan costs can vary based on the.

The national average cost of car insurance in is roughly $ per year (or $64 per month). This average rate is for a minimum coverage policy. The national median monthly cost of business insurance for new Progressive customers ranged from $42 for professional liability to $67 for workers'. The average car insurance rate in Florida is $1, per year — % more than the U.S. average. But auto insurance prices are dictated by factors other than. Premium – this is the amount you pay every month to have your healthcare plan, in the same way you might pay monthly for your car insurance. · Deductible – this. Insurance rates are extremely localized. I'm curious to see what anyone else in South Florida is paying. I'm around /mo for comprehensive on. Your responses will help you get the right level of protection for a great price. Learn more about factors that impact your car insurance coverage needs. The. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. Oxford Health Insurance, Inc. 14 Central Park Drive Hooksett, NH What You Pay Per Month. Search. The average monthly pet insurance premium is $ for dogs and $ for cats, according to the latest report published by the North American Pet Health. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the data. The average cost of a BOP is only $57 per month for Insureon's small business customers. View video transcript. Bundle up. A business owner's policy includes. Other rate factors; FAQs. Many factors affect car insurance rates, so premiums can vary widely among drivers. The national average monthly cost of car insurance. costs, and your annual deductible may be lower. Compare your anticipated care needs to the average health insurance cost per month for the plans you are. The average cost of purchasing your own health insurance in this way is US$ per month for unsubsidised individuals in the USA, according to a survey by. How much is the average cost of car insurance in the U.S? The average cost for car insurance in the United States is $1, per year, or $ per month. While the average price of renters insurance across the U.S. is $18/month, Lemonade renters insurance rates are quite competitive at an average of just $14/. Arizona drivers pay average car insurance rates of $92 per month for liability-only coverage and $ per month for full coverage — lower than the national. What is the average cost of health insurance per month? · The average monthly health insurance cost for a year-old's individual plan is $/month. · Virginia. Average full coverage auto insurance rates are $ per month, so any policy $ or less would be a good price for car insurance. Why.

1 2 3 4 5 6 7